Things about Guided Wealth Management

Table of ContentsGuided Wealth Management for DummiesAn Unbiased View of Guided Wealth Management5 Simple Techniques For Guided Wealth ManagementThe 2-Minute Rule for Guided Wealth Management

Retirement preparation has never ever been more complex. With adjustments in tax obligation legislation and pension plan law, and hopefully a lengthy retired life ahead, people approaching completion of their careers require to navigate a significantly challenging backdrop to guarantee their economic needs will certainly be met when they retire. Add in an unclear macroeconomic environment, and the danger of not having a clear strategy can have a severe influence on retired life quality and way of life options.Looking for financial advice is a good concept, as it can help individuals to appreciate a stress-free retired life. Right here are five methods that individuals can benefit from engaging with a professional financial consultant. Collaborating with an adviser can assist individuals to map out their retirement objectives and guarantee they have the right strategy in area to fulfill those objectives.

"Inheritance tax obligation is a complicated location," says Nobbs. "There are numerous means to steer via inheritance tax planning as there are a variety of items that can assist alleviate or reduce inheritance tax.

9 Simple Techniques For Guided Wealth Management

"It can be really tough to chat to your household concerning this since as a society we don't such as talking regarding cash and fatality," says Liston. "There's a lot you can do around legacy, around gifting and around trust planning. I fret that so much of culture doesn't recognize regarding that, allow alone have access to it." If you're not making use of an advisor, how do you manage your financial investments and how do you know you've selected the ideal products for you? While on-line services make it easier for clients to see their products and performance, having an advisor available can aid customers understand the choices available to them and reduce the admin worry of managing items, permitting them to concentrate on enjoying their retirement.

Retired life planning is not a one-off event, either. With the appeal of income drawdown, "financial investment doesn't stop at retired life, so you need a component of expertise to understand just how to obtain the right mix and the right equilibrium in your financial investment solutions," claims Liston.

Some Known Details About Guided Wealth Management

For example, Nobbs was able to help one of his clients move cash into a series of tax-efficient items to make sure that she can attract an earnings and would not need to pay any type of tax till she was around 88. "They live conveniently currently and her husband had the ability to take layoff as an outcome," he claims.

"People can end up being truly stressed regarding how they will certainly money their retired life since they don't know what placement they'll be in, so it pays to have a conversation with a financial advisor," states Nobbs. While conserving is one obvious advantage, the worth of advice runs much deeper. "It's everything about offering individuals tranquility of mind, understanding their demands and aiding them live the way of living and the retirement they desire and to care for their family if anything must take place," claims Liston.

Seeking financial advice could seem frustrating. In the UK, that is sustaining a growing advice space only 11% of grownups checked stated they would certainly paid for monetary advice in the previous 2 years, according to Lang Pet cat research study.

The Guided Wealth Management Statements

"The globe of monetary recommendations in the UK is our heartland," states Liston. "If we go back several years, the term 'the Male from the Pru' resonated backwards and forwards the streets of the UK. That heritage and the breadth of our proposals imply that we can serve customers' needs at any type of factor in their life time and that assists construct count on." M&G Riches Suggestions makes monetary advice a lot more obtainable for more people.

They specialise in recommending products from Prudential and various other thoroughly picked companions. This is called a limited guidance solution.

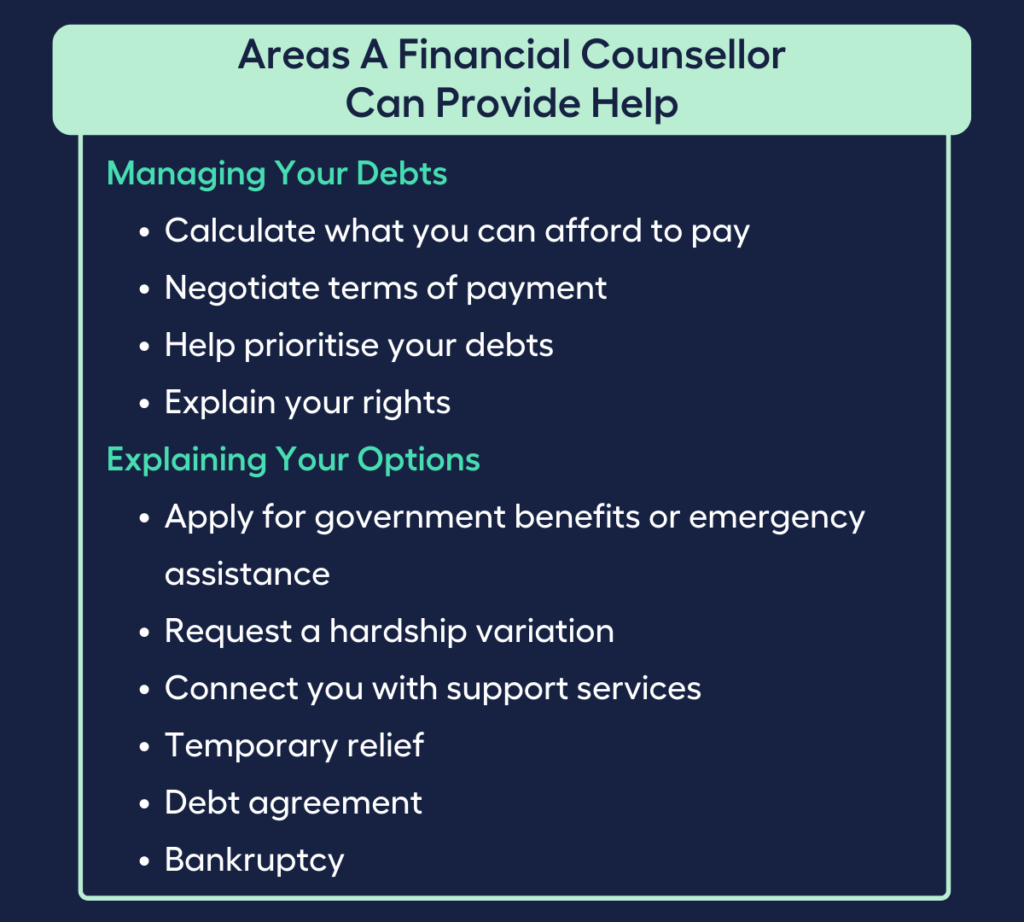

It's not almost planning for the future either (retirement planning brisbane). An economic adviser can assist change your current circumstance in addition to preparing you and your family for the years in advance. A monetary advisor can aid you with strategies to: Settle your home car loan quicker Save money and grow your assets Boost your extremely equilibrium with tax-effective techniques Secure your income Develop an investment portfolio Offer your youngsters a running start and aid them safeguard their future Like any journey, when it comes to your funds, preparation is see it here the secret